The Anthem by Banyan Tree Realty Anand Park Aundh Pune Commercial Project

Aundh,Pune

The government has also asked builders to not ask customers to pay higher tax rate on installments to be received after imposition of GST

NEW DELHI: Giving some respite to home buyers who have booked homes and made part payment, the government on Thursday clarified that the goods and services tax (GST) will actually reduce their tax outgo for payments made after July 1.

"Construction of flats, complex, buildings will have a lower incidence of GST as compared to a plethora of central and state indirect taxes suffered by them under the existing regime," the finance ministry said in a statement today.

The government has also asked builders to not ask customers to pay higher tax rate on installments to be received after imposition of GST.

"If any builder resorts to such practice, the same can be deemed to be profiteering under section 171 of GST law," the ministry added.

Hinting also on a possible reduction in home prises after GST, the government said, "The builders are expected to pass on the benefits of lower tax burden under the GST regime to the buyers of property by way of reduced prices/ installments."

The Central Board of Excise and Customs (CBEC) and states had received several complaints that in view of the works contract service tax rate under GST at 12% in respect of under construction flats, complex, etc, the people who have booked flats and made part payment are being asked to make entire payment before July 1 or to face higher tax incidence.

Clarifying the same, the ministry of finance said, "This is against the GST law."

At present, input tax credit for central excise duty, value added tax (VAT) and entry tax is not currently allowed for payment of service tax. Credit of these taxes is also not available for payment of VAT on construction of flats etc, under composition scheme.

However, under GST, full input credit would be available for offsetting the headline rate of 12%.

"The input credits should take care of the headline rate of 12% and it is for this reason that refund of overflow of input tax credits to the builder has been disallowed," the ministry said in a statement.

Magarpatta Hadapsar, Pune

PK Ornate Pimple Saudagar Pune 2BHK 3BHK

Pimple Saudagar, Pune

AR Mirador Wakad Pune 2BHK 3BHK

Wakad, Pune

Ganga Legend County Bavdhan Pune

Bavdhan, Pune

Atmos at Life Republic by Kolte Patil Marunji HInjewadi Pune

Hinjewadi, Pune

The Anthem by Banyan Tree Realty Anand Park Aundh Pune Commercial Project

Aundh,Pune

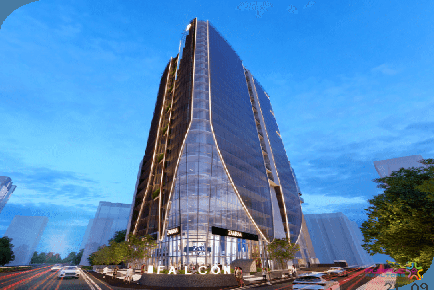

57 Avenue Wakad Pune Commercial Project

Wakad,Pune

West View by Panchshil Koregaon Park Pune Commercial Project WestView

Koregaon Park,Pune

Amar Summit Shivaji Nagar Pune Commercial Office Spaces Price Location Floor Plan

Shivajinagar,Pune

WYNG By Kundan Spaces Camp Pune Commercial Office Space Price Location Floor Plan Review

Pune,Pune

M Triumph by Malpani Shivajinagar Pune Showroom Office Space

Shivajinagar,Pune

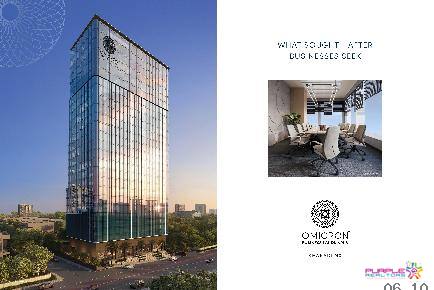

Omicron Business Landmarks Kharadi Nx Pune Commercial Project

Kharadi,Pune

Kushal Wall Street F C Road Pune Commercial Retail and Office Spaces Price Location Floor Plan

F C Road,Pune

SBH Solitaire Business Hub 3 Baner Pune Office Space Commercial Project Spaces For Sale and Lease

Baner,Pune

M RAMANUJAN BY MALPANI BANER PUNE COMMERCIAL PROJECT

Baner,Pune