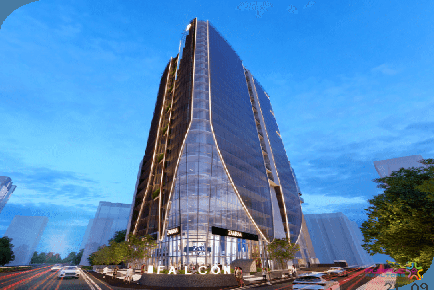

ATP Amar Tech Park Balewadi Pune Commercial IT Park

Balewadi,Pune

Home loan is a long-term financial commitment and it is important to ensure your EMIs are within your budget and do not impact your monthly income. It is seen as a financial burden which has to be planned very carefully.

A prudent borrower will plan it wisely to make his home loan EMIs affordable. Often, home buyers choose a long-term home loan in order to pay a lower EMI but end up paying more interest.

These easy steps can help you reduce the total interest on your home loan.

Short-term loan

Buyers should choose a short-term for their home loans as it ensures a reduced long-term financial commitment. A 15-year loan is better than a 20-year home loan as it results in a lower interest rate on your total amount. Your monthly EMI may be higher but interest will be less. A short-term tenure means the principal amount of your loan is paid faster leads to lower interest rate because interest is calculated on the outstanding principal amount.

Reduce interest rate

You must always choose the lowest interest rate home loan and go ahead with refinancing of your loan if your interest rate is coming down.

Pay the principal

Make sure that you are paying the principal as quickly as possible as the lesser principal amount means lesser interest to be paid to the bank. If you have extra cash in hand then try to give it to the bank and get your principal amount reduced. Some buyers do that so that the EMI interest can come down.

More than one EMI

You can also pay more than one EMI every year. This will reduce your loan tenure and interest cost as well. It is very important to calculate your finances based on your income. It will make you pay more but ultimately you will be benefited.

Higher EMI

With rise in your salary, you can choose to pay a higher amount of EMI. It is good to reduce your home loan interest burden. You can calculate the interest rate as per your home loan amount, tenure and interest to find out how much amount you are paying less by this step.

Compare interest rates

Banks will not reduce the interest rate to the existing home loan borrowers till you go there and ask them to do it and fill a form for the same. If your existing bank does not reduce the interest rate then find out which bank is offering you lower interest rate and get your loan refinanced. You must also find out the charges for switching the loan before going ahead with refinancing.

These are some tips for home loan borrowers to help them reduce the burden of home loans. The government is already giving the CLSS benefit to buyers purchasing affordable homes. You can also opt for that so you pay less amount of EMI. A short-term loan may reduce your interest payout but it will increase your EMI and may impact your monthly income. You need to choose the EMI amount that is affordable to your pocket.

Serenopolis by Nirman Tathawade Wakad Pune 2BHK 3BHK

Tathawade, Pune

GERA JOTT JOY ON THE TREETOPS HINJEWADI PUNE 2 BHK 3 BHK

Hinjewadi, Pune

ATP Amar Tech Park Balewadi Pune Commercial IT Park

Balewadi,Pune

AMAR AD One Baner Pune Commercial Project Office space Price Location Floor Plan Review

Baner,Pune

M RAMANUJAN BY MALPANI BANER PUNE COMMERCIAL PROJECT

Baner,Pune

Mont Vert Montclaire Baner Pune Commercial Projects Office Spaces Available For Sale and Lease

Baner,Pune

Kakkad One World Baner Balewadi Pune Commercial Project

Balewadi,Pune

La Commercia Baner Pune Commercial Shop Showroom Office Space For Sale Lease

Baner,Pune

SBH Solitaire Business Hub Baner Pune Office Space Showroom Restaurant Spaces For Lease and Sale on High Street Balewadi

Baner,Pune

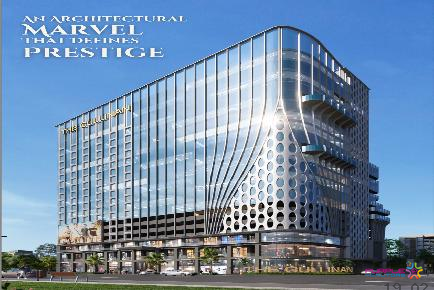

The Cullinan by Garve Pimple Nilakh Pune Commercial Project Floor Plan Review

Pimple Nilakh,Pune

Westend Icon Aundh Pune Commercial Office Spaces for Lease

Aundh,Pune

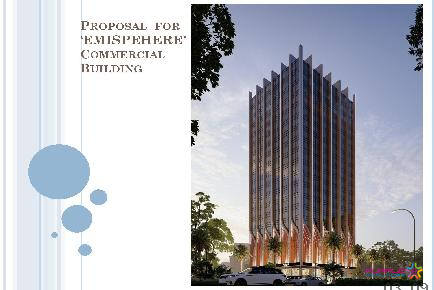

Emispehere Balewadi Pune Commercial Project

Balewadi,Pune