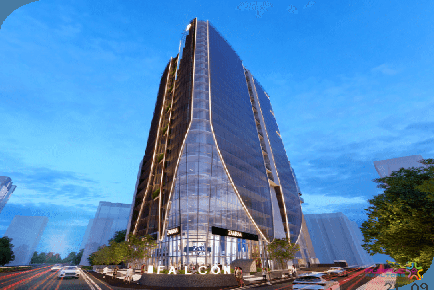

SBH Solitaire Business Hub 3 Baner Pune Office Space Commercial Project Spaces For Sale and Lease

Baner,Pune

The spill-over effect of demonetisation, implementation of the Real Estate (Regulation & Development) Act, 2016 and the Goods & Services Tax - a triple ripple - had a dramatic impact on Indian Real Estate Sector in 2017. These three consequential reforms invited a complete overhaul in the property sector, its form and practices. Now, with the dust gathered by the RERA and the GST settling down, the realty sector is on the verge of incarnation and ready to embrace 2018, but with full of challenges and opportunities.

The year 2018 is set to begin on a 'carry forward' note, where the unsold inventory accumulated in the third quarter of 2017, around 685,000 units in seven cities, due to sluggish demand. The year may help in easing this gradually, as consumers are turning back to the sector with time correction and lower interest rates. The price easing factor due to the 'triple ripple' effect rescued the developers to cope up with the pressure of unsold inventories to some extent, but with no further price correction anticipated in the year 2018. With the impact still continuing, the year 2018 will majorly be the year full of disruptions for the real estate sector. Let us evaluate - how.

RERA: Key driver to consumer sentiments

A 'Developer' dominated market is turning to be a 'Customer' dominated market as the RERA has empowered the buyers with multiple rights. The factors like transparency in dealings, mandatory timelines, risk-free mechanism to protect financial and fiduciary interests of the buyers will ensure a fair play. The homebuyer, who was sitting on the fence due to uncertainties related to deliveries and no recourse available against builders, has gained confidence thanks to RERA.

For instance, the increasing number of RERA registrations in Maharashtra and Mumbai alone is indicative of developer's sensitivity to the issue. Bringing every act of the developer under the RERA net will improve overall confidence of the buyer in the developer and the sector at large.

Prime Minister's resolve on 'Benami' properties

Prime Minister reiterated his resolve to crack down on Benami properties and transactions. Assets like real or fictitious land, shops, flats purchased via Benami transactions or where the demonetised currency is locked in, will receive the harshest treatment. The year 2018 will see stringent actions against the culprits and ensure further clean-up in the sector.

Clean capital to drive inflows

Due to a lack of transparency and credibility, the sector was struggling to get 'clean capital' from financial institutions and institutional investors that paved ways for raising capital through illicit ways. Now with transparency and project approvals in place, a credible developer can now raise finance in a clean way. Demonetisation has further blocked the ways of illegal finances streaming into construction projects. Many financial institutions and investors have already opened up avenues for clean capital. Of late, about Rs 3,000 crore realty funds were announced by various entities just to finance a category of projects, mainly affordable housing projects.

Residential prices to remain stable

Residential prices will mostly remain stable in the early quarters of 2018. Past couple of months, there hasn't been a significant correction in prices as far as the primary market catalogue rates are concerned. While builders have been offering incentives for long, they have also been negotiating discounts with prospective homebuyers to ensure faster deal conclusion. With some rationalisation in the secondary market too, the momentum of sales and new launches may accelerate.

'Pradhan Mantri Awas Yojana' (PMAY) to reshape 'Housing for All'

The Prime Minister's ambitious plan of building homes for all by 2022 is set to stir economic revolution worth $1.3 trillion, which is higher than Mexico's GDP, creating 60 million new houses and over 2 million jobs annually. With almost every project being registered under the PMAY scheme, the urban realty sector is equipping new-age buyers with efficient homes at attractive prices. The year 2018 will be no exception to this trend.

Further boost to affordable housing

In response to PM's Vision of 'Housing for All', the developers have come forward with multiple 'affordable housing' options. From a ticket size of Rs 10 lakhs to Rs 50 lakhs, many affordable housing projects are becoming popular among the buyers in tier I and II cities. Many real estate funds are also pumping money to support developers and the momentum is expected to pick up in 2018.

Wave of consolidation

The RERA has underpinned a wave of consolidation in the market. Strict compliance and transparency regime, adherence to quality and project timelines, etc. will force many unorganised developers shut shops or transfer the businesses to developers with sustained credentials. Homebuyers' and lenders' rise, subsequent action by the courts and the government against builders like Unitech, Jaypee Infratech and Amrapali is an indication as to how business environment is changing. It will accelerate the pace of consolidation and the sector will witness a class of organised or branded developers emerging strongly across project categories. Many incomplete, long-hauled projects stuck due to legal or financial intricacies may see handovers to organised developers. The merger & acquisition experts foresee many buy-outs, mainly by top league developers, in the year 2018.

Category diversification to be must

The branded or corporate developers will further expand their scope of business categories. For instance, some branded developers catering to ultra-luxury segment expanded their focus on compact, efficient, boutique homes for high and mid-level income category of buyers. The trend is expected to pick up further.

Amberwood Pimple Saudagar Pune 3BHK 4BHK Price Location Floor Plan Review

Pimple Saudagar, Pune

Excellaa Virtu Pimple Nilakh Pune 3 BHK Price Location Floor Plan Review

Pimple Nilakh, Pune

SBH Solitaire Business Hub 3 Baner Pune Office Space Commercial Project Spaces For Sale and Lease

Baner,Pune

SAI MILLENIUM PUNAWALE PUNE COMMERCIAL PROJECT

Punawale,Pune

M RAMANUJAN BY MALPANI BANER PUNE COMMERCIAL PROJECT

Baner,Pune

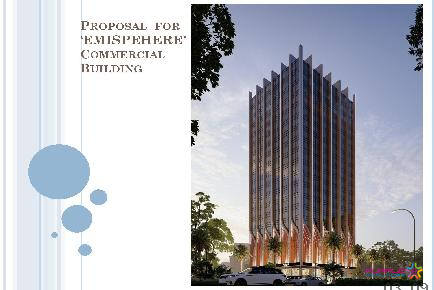

Emispehere Balewadi Pune Commercial Project

Balewadi,Pune

ATC Amar Tech Center Viman Nagar Pune Commercial Office Space For Lease

Viman Nagar,Pune

Westend Icon Aundh Pune Commercial Office Spaces for Lease

Aundh,Pune

AP4 Tech Park by Amar Builders Wagholi Kharadi Pune IT Park

Kharadi,Pune

KWT KOHINOOR WORLD TOWER PIMPRI PUNE COMMERCIAL OFFICE SPACE SHOP SHOWRROM

Pimpri Chinchwad PCMC,Pune

GIT Gaurav Icon Tower Wakad Pune Commercial Office Space Showroom Price Location Floor Plan Review

Wakad,Pune

Amar Summit Shivaji Nagar Pune Commercial Office Spaces Price Location Floor Plan

Shivajinagar,Pune