Kushal Wall Street F C Road Pune Commercial Retail and Office Spaces Price Location Floor Plan

F C Road,Pune

The Goods and Services Tax (GST), which was imposed on July 1 last year, radically changed many things in Indian economy. One change that has gone unnoticed is its impact on the Budget. The GST has shorn the Budge its suspense and mystery by taking away half of its work, the indirect taxes. Now GST Council decides tax rates for goods and services. In fact, Finance Minister Arun Jaitley had dropped indirect tax proposals in his previous Budget in anticipation of GST coming in force after a few months.

The Budget now is mostly about allocations, direct taxes and customs duties and levies.

Indirect taxes gave the Budget its mass connect, though income tax is still a big item of curiosity for the masses. Earlier, the Budget got the attention of every Indian, right from the man who sold bidis by the roadside to the middle-class housewife looking to buy jewellery.

People avidly waited for the Budget to know what got costlier and what got cheaper.

Days before it was presented in the Parliament, Budget occupied the mindspace of common Indians. Small shopkeeper would start hoarding items that were rumoured to be taxed more. Or rates of such items would already go up.

Due to indirect taxes, the Budget had everything for everyone. Rich or poor, young or old, student or professional, businessman or roadside vendor, every Indian instantly felt the impact of the Budget.

The Budget was the time the aam aadmi hogged the news. Much before it was presented, the media made a beeline for the aam aadmi, asking him about his expectations. It was also the time when aam aadmi could hold forth on a complex subject with authority.

After the Budget, the aam aadmi would rate the Budget. Everyone had something or the other to say about it. Right after the Budget was out, one could feel the pulse of the nation as everyone had an opinion on the government. The Budget was a great festival of democracy that galvanised the whole of India.

Now, except income tax, there is little in the Budget that would make an instant connect with the masses. Of course, various schemes, from agriculture to housing, do impact lives of all Indians. But indirect taxes were about the items of daily use.

The government was deciding important parts of your daily life. Fiscal deficit or a Krishi Sinchai Yojna does not evoke the reaction that cheaper refrigerators or costlier branded clothes do.

Before last year, the finance minister's budget briefcase was seen as a riddle wrapped in a mystery inside an enigma. As he entered the Parliament brandishing his briefcase, people looked at it with apprehensions as well as expectations. The Goods and Services Tax (GST) has changed all that.

In a way, the finance minister has lost a big part of his power. It was a standard ritual for various industry bodies and other pressure groups to line up at his office to plead their cases for concessions, rebates and other benefits. Now, it's the GST Council that gets their attention.

Kalash Montage Baner Pashan Link Road 3 and 4 BHK Price Location Floor Plan Review

Baner Pashan Link Road, Pune

Livience Aleenta Baner Pashan Link Road Pune 3 BHK 4 BHK Price Location Floor Plan Review

Baner Pashan Link Road, Pune

Legacy The Statement Pimple Saudagar Pune 3 BHK 4 BHK Price Location Floor Plan Review

Pimple Saudagar, Pune

Godrej Emerald Waters Pimpri Chinchwad Pune 1BHK 2 BHK 3 BHK 4 BHK Price Location Floor Plan Review

Pimpri Chinchwad PCMC, Pune

Kushal Wall Street F C Road Pune Commercial Retail and Office Spaces Price Location Floor Plan

F C Road,Pune

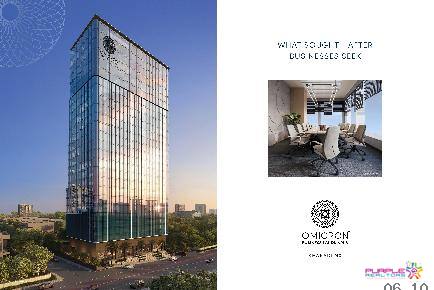

Omicron Business Landmarks Baner Pune Commercial Project

Baner,Pune

Omicron Business Landmarks Kharadi Nx Pune Commercial Project

Kharadi,Pune

SBC Sadanand Business Center Baner Pune Commercial Office Space Lease Location

Baner,Pune

One Place F C Road Pune by Mittal Brothers Commercial Project Shop Showroom Office Space For Sale n Lease Price Location Floor Plan

F C Road,Pune

Pride Gateway Baner Pune Commercial Project

Baner,Pune

M Connect by Malpani Bavdhan Pune Commercial Office Spaces For Lease

Bavdhan,Pune

La Commercia Baner Pune Commercial Shop Showroom Office Space For Sale Lease

Baner,Pune

KBT Kohinoor Business Tower Baner Pune Commercial Project Office Space Price Location Review

Baner,Pune

Haute Capital by Bhansali Baner Pune Commercial Project

Balewadi,Pune