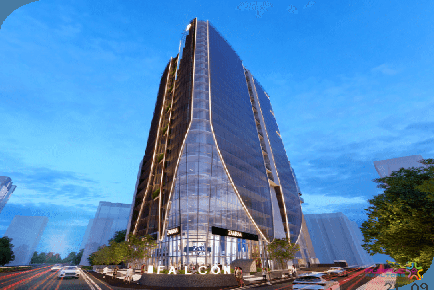

NAIKNAVARE SEVEN 7 BUSINESS SQUARE SHIVAJINAGAR PUNE SHOWROOM OFFICE SPACE

Shivajinagar,Pune

Pune

Women employees, especially those pursuing their first job, have a key reason to rejoice. With the promise of a higher take-home pay packet, lower interest rates on home loans for women, reduced stamp duty, and a slew of affordable housing options on offer, there's more power to the young woman on a home-hunt.

It's every modern-day woman's dream to enjoy independence and being a home-owner is an apt way to achieve just that, isn't it? With prudent planning, she can now own one, especially if she's bagged her first job. The amendment to the Employee's Provident Fund & Miscellaneous Provisions Act, 1952 will allow women employees to take home more. This means, while employer's contribution of 12 percent will continue, new women employees will not be required to pay 12 percent of their basic salary as EPF contribution for three years as this will be borne by the government.

The government's Housing for All by 2022 Scheme, which states that women should be either co-owners or sole owners of an affordable house, clearly empowers more women to aim for that dream home more than ever.

First-home subsidy

The Credit Linked Subsidy Scheme (CLSS) has given the first-time woman home-buyer more benefits. If her annual household income is less than Rs 6 lakh per annum, she is eligible for an interest subsidy of 6.5 percent on the principal of Rs 6 lakh.

Tax benefits

Women borrowers are eligible for tax benefits on home loans. Her home loan repayments can reduce her taxable income upto Rs 3.5 lakh. Eligibility for tax deductions on interest paid on home loans is upto Rs 2 lakh for women. Maximum tax deduction allowed in the principal and interest repayments is Rs 1.5 lakh and Rs 2 lakh respectively.

Start early

Believe in starting early. If a woman embarks on her career when she's 22 years with, for example, an average salary of Rs 4.5 lakh/annum, which is the average employee salary in the IT industry, she can opt for a home loan when she is 25-26 years. By this time, her income could be around Rs 6-8 lakh based on her increments. Most banks offer home loans upto 60 times of the net. For example, if the net pay is Rs 50,000, the employee would be eligible for a home loan of upto Rs 30 lakh. She can look for affordable housing projects that offer homes within this budget.

NAIKNAVARE SEVEN 7 BUSINESS SQUARE SHIVAJINAGAR PUNE SHOWROOM OFFICE SPACE

Shivajinagar,Pune

M RAMANUJAN BY MALPANI BANER PUNE COMMERCIAL PROJECT

Baner,Pune

Achalare Business Capital Baner Pune Commercial Project

Baner,Pune

SBH Solitaire Business Hub Baner Pune Office Space Showroom Restaurant Spaces For Lease and Sale on High Street Balewadi

Baner,Pune

One Place F C Road Pune by Mittal Brothers Commercial Project Shop Showroom Office Space For Sale n Lease Price Location Floor Plan

F C Road,Pune

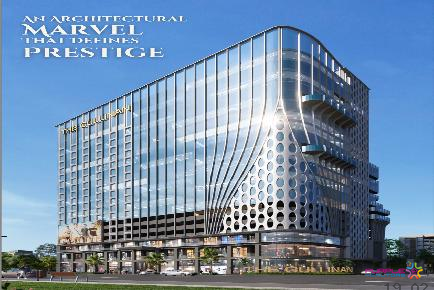

The Cullinan by Garve Pimple Nilakh Pune Commercial Project Floor Plan Review

Pimple Nilakh,Pune

West Avenue Aundh Pune Commercial Project Office Space Shop Price Loaction Floor Plan Review

Aundh,Pune

Poonawalla Towers by Amar Builders Bund Garden Pune Commercial Project

Bund Garden Road,Pune

Astra Heights Balewadi Pune Commercial Project For Lease

Balewadi,Pune

SAI MILLENIUM PUNAWALE PUNE COMMERCIAL PROJECT

Punawale,Pune