La Commercia Baner Pune Commercial Shop Showroom Office Space For Sale Lease

Baner,Pune

A number of financial and non-financial factors influence the decision of buying a dream house. While most people aim to own at least one house in their lifetime, sometimes it can be a smart decision to rent one until the right opportunity comes along.

Here are certain factors that can help you decide whether to buy a property or rent it out:

Non-Financial Factors

Sense of security: For many, owning a house is a sign of psychological security and a status symbol. Culturally, home ownership, like gold, is also seen as an asset one can turn to in times of financial difficulty.

More control: Rented houses come with their own set of restrictions on what a tenant can do. Typically, landlords do not permit major modifications or customisation. Also, there is a disincentive to spend on the house, which you don’t own.

Location & life uncertainties: Often people have to move to different cities or even countries due to their career needs. Home ownership in such cases is not considered a wise option until made purely for investment purpose or generate rent out of it. Also, if you haven’t really zeroed in on the ideal location in a city, it may make sense to rent it out rather than buy. The decision can also be influenced by where you want to live –suburbs, close to the workplace or in city’s central localities.

Financial factors

EMI vs rent: Both involve a monthly outflow of finances. However, many people see equated monthly instalment (EMI) as a contribution towards building a significant asset, rent, on the other hand, can be viewed as a monthly expenditure that doesn’t build an asset.

Income level & certainty: Your finances are a decisive factor in buying/renting a home. Paying EMIs could be a huge burden on your budget and are spread across a period of an average of 10-20 years. Factor in your household and investment expenditure, if you plan to buy a home. Also, consider income stability. Uncertainty about future cash flows makes renting a better option as it gives you the flexibility of moving to a place with a lower rental.

The mathematics: A number of calculators are available online for you to make the right decision of whether to buy or rent a property. These calculators take into account hard numbers like the initial down payment, amount of loan, property appreciation, and compare it with expected rent payout and opportunity cost of money saved and share recommendations. But, these calculators inherently assume financial discipline and optimum investment of money saved as down payment. Typically, the maths works out for a buy decision if one intends to stay there for a long period.

Tax benefits: To encourage home ownership, the government extends tax breaks on both interest and principal. A home owner can also get tax breaks on capital gains when a house is sold provided certain conditions are met. Home buyers can avail deduction on principal repaid and also, on interest payment for both self-occupied and rented houses. This lowers effective cost of home ownership.

Serenopolis by Nirman Tathawade Wakad Pune 2BHK 3BHK

Tathawade, Pune

Yoo Pristine Akurdi PCMC Pune 2 BHK 3 BHK 4 BHK

Pimpri Chinchwad PCMC, Pune

Amberwood Pimple Saudagar Pune 3BHK 4BHK Price Location Floor Plan Review

Pimple Saudagar, Pune

PYRAMID ATLANTE WAKAD PUNE 2BHK 3BHK

Wakad, Pune

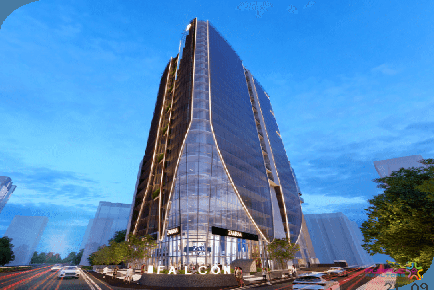

La Commercia Baner Pune Commercial Shop Showroom Office Space For Sale Lease

Baner,Pune

KBT Kohinoor Business Tower Baner Pune Commercial Project Office Space Price Location Review

Baner,Pune

Supreme HQ Headquarters Baner Office Space showroom

Baner,Pune

Vertica Balewadi Pune Commercial Project

Balewadi,Pune

SBH Solitaire Business Hub Baner Pune Office Space Showroom Restaurant Spaces For Lease and Sale on High Street Balewadi

Baner,Pune

West Avenue Aundh Pune Commercial Project Office Space Shop Price Loaction Floor Plan Review

Aundh,Pune

NAIKNAVARE SEVEN 7 BUSINESS SQUARE SHIVAJINAGAR PUNE SHOWROOM OFFICE SPACE

Shivajinagar,Pune

Haute Capital by Bhansali Baner Pune Commercial Project

Balewadi,Pune

M RAMANUJAN BY MALPANI BANER PUNE COMMERCIAL PROJECT

Baner,Pune

Teerth Exchange Baner Pune Commercial Project Office Space Showroom Lease Floor Plan Review

Baner,Pune