B5 Tech Park JST Jayka Synergy Tower Baner Pune Commercial Project

Baner,Pune

Moneycontrol News

Losses of internet-based real estate companies -- Housing.com, PropTiger, MagicBricks, 99acres and CommonFloor -- jumped nearly 65 percent collectively to Rs 762 crore for the year ended March 31, as per a report by the Financial Express.

However, notwithstanding the loss, the revenues of the companies have increased from Rs 311 crore from Rs 173 crore in 2014-15.

Legal Experts say consistent losses in the books of these companies, despite increasing revenues, might foster consolidation in the space.

Previous acquisitions

Quikr acquired CommonFloor to expand its network in the segment. In 2015 end, Quikr acquired agents aggregator Indian Realty Exchange and analytics firm RealtyCompass.

Both Quikr and CommonFloor had Tiger Global as their main investor.

Maxheap Technologies, promoter of CommonFloor, reported 50 percent increase in losses to Rs 131 crore and a minor drop in revenues to Rs 31 crore for FY16.

PropTiger acquired the Softbank-backed promising startup Housing.com in January 2017. The real estate startup was valued at USD 70-75 million, which took the value of the merged entity to USD 270-285 million.

Housing.com’s online leads for property complemented PropTiger’s offline operations.

In FY16, however, combined losses of the two entities mounted 46 percent to Rs 462 crore, even as revenue doubled to Rs 43 crore.

On the other hand, losses for the online property platform 99acres, owned by Info Edge, more than doubled during FY16 to Rs 91 crore. Revenue though, only improved marginally to Rs 111 crore from Rs 110 crore in the previous fiscal.

According to InfoEdge’s management, the growth in 99acres moderated due to demonetisation and uncertainties due to the Real Estate (Regulation and Development) Act (RERA).

Samir Jasuja, CEO and Founder of PropEnquiry pointed out that demonetisation in November 2016 was responsible for slowed transaction in real-estate companies.

“Following the merger and acquisitions, raising capital will be problem if revenues continue to be static and show no growth,” he said.

WYCE Exclucity Bavdhan Pune 2BHK 3BHK 4BHK

Bavdhan, Pune

Rohan Saroha Bhugaon Bavdhan Pune 2 BHK 3 BHK 4 BHK Price Location Floor Plan

Bhugaon Bavdhan, Pune

B5 Tech Park JST Jayka Synergy Tower Baner Pune Commercial Project

Baner,Pune

NAIKNAVARE SEVEN 7 BUSINESS SQUARE SHIVAJINAGAR PUNE SHOWROOM OFFICE SPACE

Shivajinagar,Pune

ATP Amar Tech Park Balewadi Pune Commercial IT Park

Balewadi,Pune

Malpani M Kautilya in Viman Nagar Pune Upcoming Commercial Project

Viman Nagar,Pune

ABP AMAR BUILDERS AMAR BUSINESS PARK BANER PUNE OFFICE SPACE FOR LEASE

Baner,Pune

M AGILE BY MALPANI BANER PUNE COMMERCIAL PROJECT

Baner,Pune

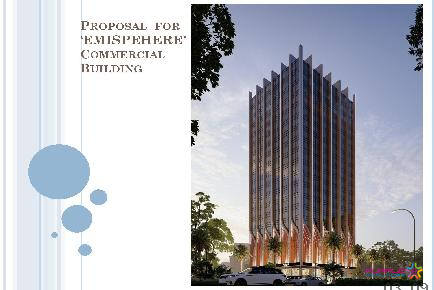

Emispehere Balewadi Pune Commercial Project

Balewadi,Pune

WYNG By Kundan Spaces Camp Pune Commercial Office Space Price Location Floor Plan Review

Pune,Pune

Omicron Business Landmarks Baner Pune Commercial Project

Baner,Pune

One Place F C Road Pune by Mittal Brothers Commercial Project Shop Showroom Office Space For Sale n Lease Price Location Floor Plan

F C Road,Pune