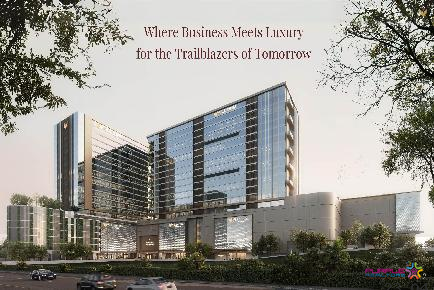

Rahul Altimus Baner Pune Commercial Project

Baner,Pune

Builders feel while for all other sectors GST comprises of their total indirect tax liability, for real estate GST regime does not eliminate multiple taxation

NEW DELHI: Builders body Confederation of Real Estate Developers Association of India (CREDAI) has urged the government to consider accommodating the abatement of land value in the new goods and services tax (GST) regime to ensure that home prices don’t rise.

Builders feel while for all other sectors GST comprises of their total indirect tax liability, for real estate GST regime does not eliminate multiple taxation.

"Developers will still have to bear other expenses like stamp duty which ranges from 5-8% of the value of the immovable property. An additional imposition of GST of 12% on land values is another drawback which will affect the growth of the industry, especially in cases where land value is relatively high," said Jaxay Shah, president, CREDAI.

CREDAI also highlighted that availing input tax credit may not be feasible under GST, thus limiting the capacity of developers to absorb the additional tax burden or pass on the benefits to homebuyers.

The government on Thursday had clarified that construction of flats, complex, buildings will have a lower incidence of GST as compared to a plethora of central and state indirect taxes suffered by them under the existing regime.

It has also said that builders are expected to pass on the benefits of lower tax burden under the GST regime to the buyers of property by way of reduced prices or lower installments.

Trump Tower Kalyani Nagar Pune 5 BHK

Kalyani Nagar, Pune

Ganga Legend County Bavdhan Pune

Bavdhan, Pune

Rahul Altimus Baner Pune Commercial Project

Baner,Pune

Laxmi Avenue Commercial Wakad Pune

Wakad,Pune

WYNG By Kundan Spaces Camp Pune Commercial Office Space Price Location Floor Plan Review

Pune,Pune

La Commercia Baner Pune Commercial Shop Showroom Office Space For Sale Lease

Baner,Pune

Cornerstone Maruti Millennium Tower Baner Pune Commercial Project

Baner,Pune

Nandan PROBIZ Balewadi Pune Commercial Project

Balewadi,Pune

45 Icon Baner Pune Commercial Office Spaces For Lease

Baner,Pune

Phoenix Millenium Towers Wakad Pune Commercial Office Space

Wakad,Pune

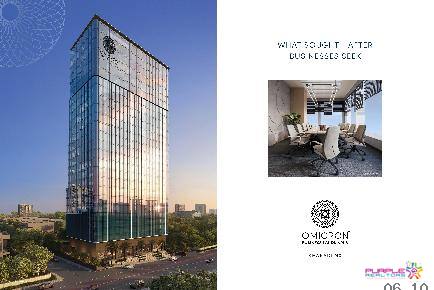

Omicron Business Landmarks Kharadi Nx Pune Commercial Project

Kharadi,Pune

The Anthem by Banyan Tree Realty Anand Park Aundh Pune Commercial Project

Aundh,Pune