WYNG By Kundan Spaces Camp Pune Commercial Office Space Price Location Floor Plan Review

Pune,Pune

Pune

With renewed transparency and accountability in the real estate market, investing in Pune realty could prove good value for money for NRIs. The market sentiment too is upbeat with lucrative property rates, attractive finance schemes from banks and offers and discounts from developers.

As the festive season begins, real estate developers in the Pune region have high hopes from the Non-Resident Indian (NRI) investors to bring a boom in the market and put it back on the fast track. Their aspirations and expectations rise from the fact that most NRIs visit India around this time of the year. The realtors expect that with improving infrastructure, low property prices and economic and political stability, its an ideal time for NRIs to put their money in Pune real estate.

In earlier years, the opaque nature of the realty business, with its lack of information and no due diligence, did not inspire much confidence in the Pune diaspora. However, with some of the key policy changes in the past one year, like the Real Estate Regulation Act (RERA), demonetisation, the Goods and Services Tax (GST), NRIs will now be more confident in making an investment decision. Also, to simplify the purchasing processes, several rules and regulations have been amended. In addition, lenient FEMA policies and relaxation of laws by the RBI regarding property buying by NRIs, are likely to boost their participation.

NRIs are also aware that residential inventory has piled up and they are currently very well-placed to find good bargains in these markets, as most developers are offering discounts and other attractive schemes. However, once the economy begins to grow, housing demand is again going to rise and it will lead to price escalation. So, for NRIs who are waiting on the edge, this is the right time to invest. Once the primary residence is secured, with surplus funds they can also invest in rental income-generating apartments or commercial properties as well. However, they should we wary of projects by unknown developers who have no existing track record. NRIs should strictly follow a check-list of points to verify, such as the RERA registration of developer, his track record and brand visibility, the soundness of the identified location in terms of civic and social infrastructure and amenities in the project.

AR Mirador Wakad Pune 2BHK 3BHK

Wakad, Pune

M Soul Strings by Malpani Group Baner Pashan Pune 3 BHK and 4 BHK Price Location Floor Plan Review

Baner Pashan Link Road, Pune

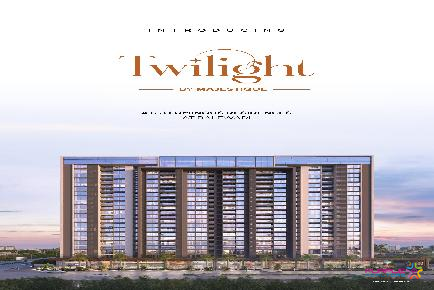

Twilight by Majestique Balewadi Pune 3 BHK 4 BHK Light

Balewadi, Pune

WYNG By Kundan Spaces Camp Pune Commercial Office Space Price Location Floor Plan Review

Pune,Pune

West Avenue Aundh Pune Commercial Project Office Space Shop Price Loaction Floor Plan Review

Aundh,Pune

One Place F C Road Pune by Mittal Brothers Commercial Project Shop Showroom Office Space For Sale n Lease Price Location Floor Plan

F C Road,Pune

La Commercia Baner Pune Commercial Shop Showroom Office Space For Sale Lease

Baner,Pune

GIT Gaurav Icon Tower Wakad Pune Commercial Office Space Showroom Price Location Floor Plan Review

Wakad,Pune

Aaiji Capital Baner Pune Commercial Project For Lease

Baner,Pune

Panchshil Eleven 11 West Baner Commercial Retail Office Space Showroom Spaces For Lease and Sale

Baner,Pune

Infinity IT Park by Raheja Aditya Shagun Baner Pune Commercial Office Space for Lease

Baner,Pune

45 Baner Street Baner Pune Commercial Project

Baner,Pune

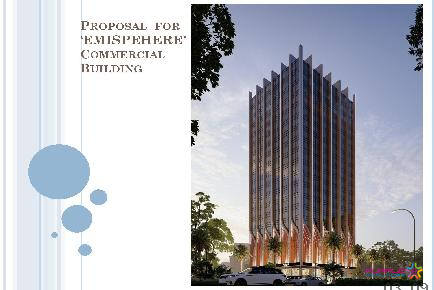

Emispehere Balewadi Pune Commercial Project

Balewadi,Pune