Tej One 1 by Tejraj Baner Pune Pancard Club Road Commercial Project

Baner,Pune

Pune

Many home buyers are still not getting the benefits of input credit to developers, despite rationalised GST rates for the real estate sector. GST rates have been brought down to 8% for affordable housing, which, considering the input credit to developers, should effectively become net zero for the consumer.

What does this mean? When a developer buys various products such as cement, steel, sand, and other construction and finishing materials from producers to build a house, the manufacturers of these materials have already paid GST on these products. As a result, the developer gets an input credit for the goods produced using these pre-taxed materials.

The idea behind input credit is that this benefit would be further passed on to a consumer. Any housing product constructed in the future will factor in these input credits as the volume of credits would have been computed by then.

However, existing homebuyers today have a problem. If you bought a house in the past few years from a developer, the price was fixed on the prevailing market price then. But the consumer then was expected to pay only 4.5-5.5% service tax and VAT on every instalment. Today, that has gone up to 8-12%. The idea was that developers would pass on the input tax credit benefit to the consumer so the effective tax would remain almost the same as the previous amount. That has not happened so far. Many consumers have been complaining on the Magicbricks Forum that the developer has not reduced the price of the property and therefore the consumer does not gain from the GST regime.

Assured the media at the recent post-Budget conference that the industry body will urge all its members to promise lower prices to existing consumers taking the input credit from GST into consideration. "This has to be done," , as the anti-profiteering arm of the GST Council would come down heavily on developers if they fail to do so.

The practical difficulty is that the entire GST process is still falling into place and developers are not able to accurately compute the volume of tax benefits that should be passed on to the consumer. What we should be doing now is assuring consumers in writing that the GST calculations would be done and the benefits would be passed on to consumers in the final instalment.

Some developers have already started giving written assurances to consumers that they would pass on the GST benefits in the last instalment.

So if your developer has not written to you yet with this assurance, now would be a good time to write to the developer for lowering of price to reflect the benefits of GST input credit from manufacturers to the developers.

Tej One 1 by Tejraj Baner Pune Pancard Club Road Commercial Project

Baner,Pune

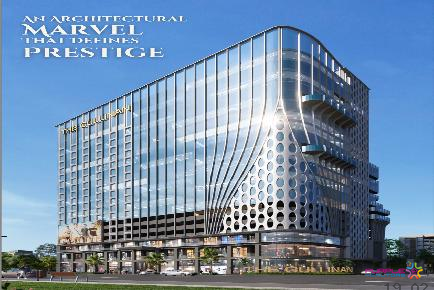

The Cullinan by Garve Pimple Nilakh Pune Commercial Project Floor Plan Review

Pimple Nilakh,Pune

Poonawalla Towers by Amar Builders Bund Garden Pune Commercial Project

Bund Garden Road,Pune

SBH Solitaire Business Hub Baner Pune Office Space Showroom Restaurant Spaces For Lease and Sale on High Street Balewadi

Baner,Pune

ONE PLACE BANER PUNE COMMERCIAL OFFICE SPACE AND SHOWROOM

Baner,Pune

Astra Heights Balewadi Pune Commercial Project For Lease

Balewadi,Pune

Wakad Business Bay WBB Wakad Pune Commercial Project

Wakad,Pune

The Anthem by Banyan Tree Realty Anand Park Aundh Pune Commercial Project

Aundh,Pune

GIT Gaurav Icon Tower Wakad Pune Commercial Office Space Showroom Price Location Floor Plan Review

Wakad,Pune

Greystone by Tremont Baner Pune Commercial Office Spaces

Baner,Pune