AMBROSIA GALAXY BANER PUNE COMMERCIAL PROJECT OFFICE SPACE SHOP SHOWROOM SALE OR LEASE

Baner,Pune

Positive cash flow or positively geared investment properties…what is the difference and is one better than the other?

Yes, there is a difference.

Positively geared investment properties are those which essentially pay you to own them.

So for example, let’s say your investment income on a particular property is 2,000 per month and you pay out 1,800 in property expenses.

Then, let’s add to that surplus another 100 for taxes and you have a positive balance of 300 per month on that property.

Put simply, then, positively geared investment properties will provide cash over and above liabilities both before and after taxes are accounted for.

Unlike positively geared investment properties, positive cash flow properties are those which are only positively geared after taxes, depreciation, expenses, etc. are deducted from the property’s income.

Quite simply that depends.

It depends upon your personal financial situation, where you’re at in your property investing career and what you hope to achieve.

Consider the following examples of what impact each type of positive cash flow property will have on an investor’s ability to grow their portfolio:

Vinod

Positive cash flow property (after taxes)

Vinod can recoup her expenses when she files taxes, but if she wants to buy another property her lender might have an issue with her financial situation.

Here’s why.

A lender will typically deduct the property expenses (in this example, 5,000) from Vinod’s $50,000 income which of course automatically impacts her serviceability.

Rahul

Positively geared investment property

Rahul’s lender will count the additional 5,000 annual pre-tax income from his positively geared investment property. This means the lender will use 55,000 per year in their calculations…obviously an improvement for Rahul’s serviceability.

![]()

If you have negatively geared properties they can become positively geared investment properties, however what if you want an investment property that’s positively geared from the start?

How do you find positively geared investment properties?

Consider market indicators such as:

Look for:

Positively geared investment properties require growth markets. Look for economic drivers that are strong and find out where the market lies within the property market cycle.

Creating positively geared investment properties

Five things you can do to improve your rental income or your property’s capital growth include:

1. Manage your debt

2. Use tax deductions to gear the property

3. Sell another property and use the capital to pay down/off your investment property’s mortgage

4. Add value through renovation

5. Add another income stream to property (e.g. granny flat, multiple tenants)

6. Refinance

For more Blogs Like this Check - https://purplerealtors.com/blog.php

Click here to like us on Facebook and see more updates like this.

Check Real Estate Updates Here - https://purplerealtors.com

For Residential Projects in Pune Check - https://purplerealtors.com/Residential-Projects

For Commercial Projects in Pune Check - https://purplerealtors.com/Commercial-Projects

If you want more tips about your Property Investment strategy, book a FREE consultation with one of our expert Investment Coaches to discuss your situation and investing goals.

Unique Sky Links Baner Pashan Pune 3 BHK 4 BHK Price Location Floor Plan Review

Baner Pashan Link Road, Pune

Mahindra Citadel Bastion PCMC Pune 2 3 4 BHK Price Locfation Floor Plan Review

Pimpri Chinchwad PCMC, Pune

Runwal The Central Park PCMC Pune 2 3 4 BHK Price Location Floor Plan Review

Pimpri Chinchwad PCMC, Pune

Lodha Magnus 3 BHK 4 BHK Flats In Hinjewadi Pune

Hinjewadi, Pune

WYCE Exclucity Bavdhan Pune 2BHK 3BHK 4BHK

Bavdhan, Pune

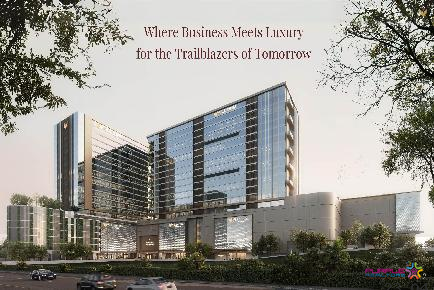

AMBROSIA GALAXY BANER PUNE COMMERCIAL PROJECT OFFICE SPACE SHOP SHOWROOM SALE OR LEASE

Baner,Pune

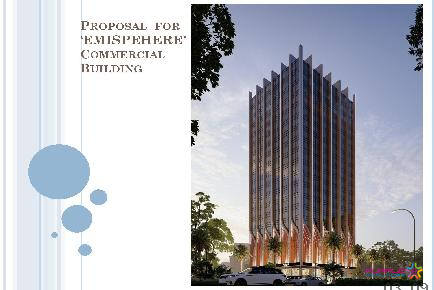

Emispehere Balewadi Pune Commercial Project

Balewadi,Pune

Jhamtani SpaceBiz Baner Pune Commercial Project Office Space

Baner,Pune

M Connect by Malpani Bavdhan Pune Commercial Office Spaces For Lease

Bavdhan,Pune

Astra Heights Balewadi Pune Commercial Project For Lease

Balewadi,Pune

Rama Metro Life Bizz Bay Tathawade Wakad Pune Commercial Project

Tathawade,Pune

Poonawalla Towers by Amar Builders Bund Garden Pune Commercial Project

Bund Garden Road,Pune

Phoenix Millenium Towers Wakad Pune Commercial Office Space

Wakad,Pune

Supreme HQ Headquarters Baner Office Space showroom

Baner,Pune

Teerth Exchange Baner Pune Commercial Project Office Space Showroom Lease Floor Plan Review

Baner,Pune