M AGILE BY MALPANI BANER PUNE COMMERCIAL PROJECT

Baner,Pune

The government has also asked builders to not ask customers to pay higher tax rate on installments to be received after imposition of GST

NEW DELHI: Giving some respite to home buyers who have booked homes and made part payment, the government on Thursday clarified that the goods and services tax (GST) will actually reduce their tax outgo for payments made after July 1.

"Construction of flats, complex, buildings will have a lower incidence of GST as compared to a plethora of central and state indirect taxes suffered by them under the existing regime," the finance ministry said in a statement today.

The government has also asked builders to not ask customers to pay higher tax rate on installments to be received after imposition of GST.

"If any builder resorts to such practice, the same can be deemed to be profiteering under section 171 of GST law," the ministry added.

Hinting also on a possible reduction in home prises after GST, the government said, "The builders are expected to pass on the benefits of lower tax burden under the GST regime to the buyers of property by way of reduced prices/ installments."

The Central Board of Excise and Customs (CBEC) and states had received several complaints that in view of the works contract service tax rate under GST at 12% in respect of under construction flats, complex, etc, the people who have booked flats and made part payment are being asked to make entire payment before July 1 or to face higher tax incidence.

Clarifying the same, the ministry of finance said, "This is against the GST law."

At present, input tax credit for central excise duty, value added tax (VAT) and entry tax is not currently allowed for payment of service tax. Credit of these taxes is also not available for payment of VAT on construction of flats etc, under composition scheme.

However, under GST, full input credit would be available for offsetting the headline rate of 12%.

"The input credits should take care of the headline rate of 12% and it is for this reason that refund of overflow of input tax credits to the builder has been disallowed," the ministry said in a statement.

Excellaa Virtu Pimple Nilakh Pune 3 BHK Price Location Floor Plan Review

Pimple Nilakh, Pune

M AGILE BY MALPANI BANER PUNE COMMERCIAL PROJECT

Baner,Pune

Cornerstone Maruti Millennium Tower Baner Pune Commercial Project

Baner,Pune

57 Avenue Wakad Pune Commercial Project

Wakad,Pune

ATC Amar Tech Center Viman Nagar Pune Commercial Office Space For Lease

Viman Nagar,Pune

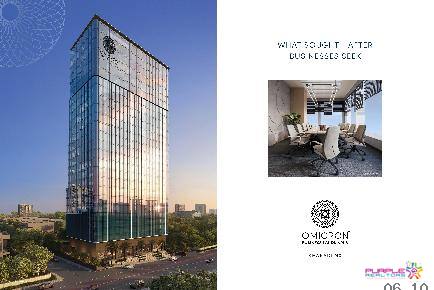

Omicron Business Landmarks Kharadi Nx Pune Commercial Project

Kharadi,Pune

Amar Builder ASTP Amar Sadanand Tech Park Baner Offices Showroom

Baner,Pune

Greystone by Tremont Baner Pune Commercial Office Spaces

Baner,Pune

Wakad Business Bay WBB Wakad Pune Commercial Project

Wakad,Pune

45 Icon Baner Pune Commercial Office Spaces For Lease

Baner,Pune

B5 Tech Park JST Jayka Synergy Tower Baner Pune Commercial Project

Baner,Pune